By Alex Plough January 9, 2015

Oil pump jack in West Texas, between Seminole and Andrews. © Paul Lowry

Cheap Oil Transforms the World

The fall in oil prices continues to transform the global economic landscape. On Wednesday the price of a barrel of Brent crude oil dipped below $50 for the first time since 2009. The biggest collapse in energy prices since the 2008 financial crisis is already tipping the balance of global economic power, away from major oil exporting nations in favor of industrialized consumers.

Below is a review of effects that $50-a-barrel oil is having in the U.S., Norway and Venezuela.

US Producers Squeezed

U.S. energy firms have kept pumping despite the plunging oil prices and evidence of rising oversupply. They borrowed heavily during the shale-fueled energy boom of the last four years, increasing their borrowings by 55% since 2010, to almost $200 billion.

The need to service this debt helps explain why US producers are maintaining production levels in the face of a glut in oil stockpiles. Oil traders have even resorted to hiring oil tankers to store excess crude at sea.

Analysts expect a wave of defaults and asset sales from the most cash-strapped producers. Research firm CreditSights Inc. has created a list of about 25 firms that are at risk, due to small asset bases, high debt and low cash flow.

The post-recession energy boom in Texas, during which the state’s economy expanded at a rate of 4.4% annually between 2009 and 2013, is facing its toughest test. On Wednesday the contract oilrig company Helmerich & Payne spooked the industry with news that it planned to mothball up to 50 rigs over the next month.

Earlier in the week WBH Energy LP, a private company that drills in Texas, filed for bankruptcy protection after a lender refused to advance it more money.

A ship named Mighty Servant 1 unloads a jack-up platform called Yme at Buøy, outside Stavanger, Norway, where it will be fitted with its three circular legs, lifeboat ramps and flare stack. © L.C. Nøttaasen

Norway Slump

Europe’s biggest crude oil producer, Norway gets 22% of gross domestic product from oil and gas revenues.

The 54 percent slump in Brent crude prices since June 2014 has severely damaged Norway’s offshore oil industry. Over the same period, the Krone has lost about 20% of its value against the dollar and 8% against the Euro, while the Norwegian stock market is down around 12%

Norway’s central bank announced a surprise interest rate cut last month that it said was needed due to falling oil prices and traders are expecting more to come.

Venezuelan Insolvency?

Nicolas Maduro, president of Venezuela, in Caracas at election time in 2013. © Joka Madruga/ TerraLivrePress.com

With 95 percent of its export revenue coming from oil, $50-a-barrel prices could force Venezuela into insolvency, according to American investment banking firm Jefferies Group LLC.

The country is already crippled by a 64% inflation rate and Venezuelans are set for more suffering despite President Nicolas Maduro’s promises to unleash a “counter offensive” on the forces destroying its economy.

On Thursday, China stepped in to help struggling Latin American oil producers, with a pledge to double trade volumes within 10 years as well as $250 billion of investment to the region.

Residents of Mérida, a major Venezuelan city, were deprived of their favorite ice cream after Coromoto, a parlor famous for its 900 flavors (including trout), closed last November because of a national milk shortage.

GREXIT with Zeus, © Tjebbe van Tijen

Grexits and Brexits

The international brinkmanship over the break-up of the European single currency in 2012 has returned this year in a war of words between Greek politicians and Eurozone leaders.

In three weeks Greeks voters will go to the polls and the current front-runner is the left-wing Syriza party, which has campaigned against the country’s punishing austerity regime.

The prospect of a Syriza government and potential Greek exit from the Euro bloc, or “Grexit” as it has become known, prompted anonymous German officials to brief weekly newspaper Der Spiegel that the euro zone would now be able to cope with a Greece exit if that proved to be necessary.

Senior Bloomberg journalist Simon Kennedy sees these actions as bluff designed to appease a German electorate tired of the financial aid given to Greece since 2010. He argues that while the single currency may be able to survive a Greek withdrawal, the threat of contagion spreading to other European countries is too great to risk for Germany.

The outcome of the Greek election will be watched closely in Britain, where a rise in anti-European Union (EU) sentiment is set to dominate an upcoming general election in May.

While the motives and circumstances surrounding a potential British exit—or “Brexit”—differ from those of Greece, both countries share rising popular anger at the EU.

Opinion polls show that up to 50 percent of Britons would vote to leave the political and economic union, an action with no legal precedent or framework in European treaties.

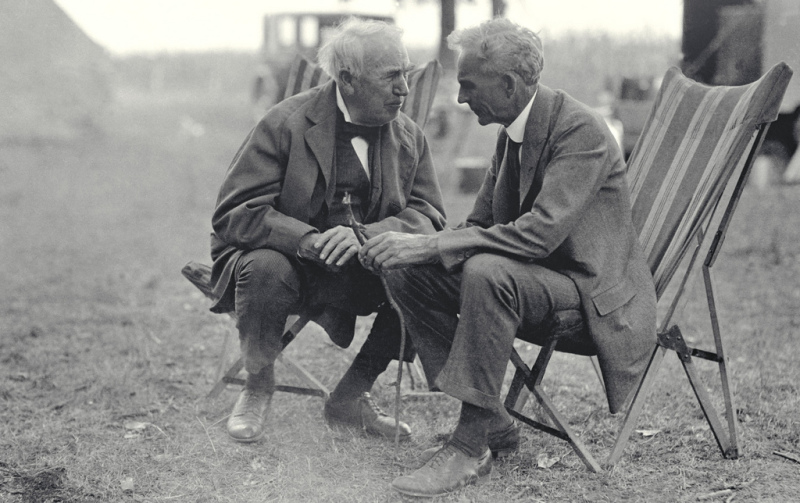

Thomas Edison and Henry Ford. © Tom Raftery, courtesy of Ford Motor Company

Famous and Famous-er

The Wall St Journal has picked 50 of history’s most famous business men and women for an interactive scatter plot where users can rank them by influence and innovation.

The ‘Influence Grid’ lets you compare your picks with those of other readers. It is fascinating to see how old leaders stack up against newer ones, such as, say, Henry Ford versus Google co-founders Larry Page and Sergey Brin.

****

Alex Plough is a freelance business journalist based in New York. Originally from London, England, he has a background in data-driven investigative reporting and has worked on a number of agenda-setting projects such as the award winning Iraq War Logs for the Bureau of Investigative Journalism. More recently he graduated from Columbia Journalism School’s masters program, business and economics reporting concentration, as well as Columbia’s Lede Program – a three month course designed to apply the tools of computer science to journalism. He is particularly interested in the overlapping fields of finance, technology and how young people are shaping the new American economy.

This entry was posted on Friday, January 9th, 2015 at 6:00 am. It is filed under Week in Review and tagged with Brent crude, CreditSights, Helmerich & Payne, Henry Ford, Larry Page, Nicolas Maduro, Sergey Brin, Thomas Edison, WBH Energy. You can follow any responses to this entry through the RSS 2.0 feed.

Comments are closed.