By Alexis Fitts April 10, 2015

A mosaic showing 1512 of the most popular videos on the YouTube video sharing service. ©Jim Bumgardner

YouTube’s New Subscription Service

An email leaked to Bloomberg News revealed that Google subsidiary YouTube is planning to launch a video subscription service, allowing viewers to pay a monthly fee to bypass ads. An anonymous source told Bloomberg that the service is expected to launch before the end of the year.

The move is meant to help Youtube combat erosion of its share of the digital video streaming market from a growing set of rivals. Popular subscription services such as Netflix, Hulu and HBO Now have already begun stealing viewers, while Facebook and Twitter, which currently send many users to YouTube, are building their own video offerings. YouTube saw its share of the video streaming traffic, as measured by total views during peak hours, fall to 14 percent in the second half of 2014 from 19 percent one year earlier. In spite of its 1 billion viewers, YouTube still does not turn a profit.

Google, which acquired the company in February of last year, wants visitors to use YouTube the way they use television, according to the Wall Street Journal, turning to it for different “channels” of content. In November, YouTube introduced a music subscription service, which offered access to the 30 million songs in Google’s Play Music database for $9.99 a month. Google has already invested hundreds of millions of dollars to boost original content on the website.

To make up for lost ad revenue, participants in the paywall program will be paid in a sharing scheme—with video partners receiving about 55 percent of subscription revenue. But some YouTube content creators worry that they will lose fans. Content creators who partner with Youtube in this subscription service must go all in, offering only videos that are behind a paywall—none for free—which, they say, could cut back on commenting and interactivity between viewers and creators.

Greece Pays Up

Greece made a $450 million euro loan repayment to the International Monetary Fund on Thursday, calming fears that the country would default on the loan. Though the payment comes as a relief to European Markets, Greece is still hurting for cash. Despite raising $1.1 billion euros from the sale of six-month bonds on Wednesday, economists predict the Greek government may run out of money within weeks.

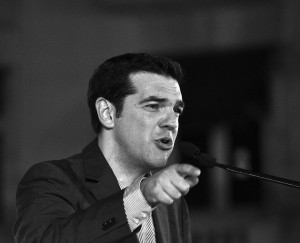

Alexis Tsipras, prime minister of Greece since January 2015 and leader of left wing Syriza party. ©Asteris Masouras

In the last five years, Athens has received two bailout funds from a so-called “troika” of lenders — the International Monetary Fund, the European Central Bank and the European Commission — totaling about $240 billion euros. Yet the bailout money hasn’t resolved Greece’s economic problems, in part because it’s been used to pay off international loans, rather than to revive the domestic economy. Unemployment tops 25 percent, and in the last five years the Greek economy has shrunk by almost a quarter.

Speaking in Paris on Thursday, Greek Finance Minister Yanis Varoufaki urged the country’s creditors to swap cash debt for bonds linked to the country’s economic growth. But that’s not his only plan for economic revival. Russia is considering giving Greece an advance on future profits from a gas pipeline project. The pipeline—which would run Russian gas through Europe via an extension of the Turkish Stream gas pipeline—is expected to lower Russian gas prices.

The country is also calling for Germany to repay World War II-era reparations for Nazi occupation. Greek Deputy Finance Minister Dimitris Mardas told a parliamentary committee that figure totals $278.7 billion euros and includes a loan the Bank of Greece was forced to make to the Nazis.

Shell and BG Group Join Forces in Mega-Merger

On Wednesday, Royal Dutch Shell announced plans to purchase BG Group PLC, an integrated natural gas company, for about $70 billion, the largest energy industry merger in a decade. The new oil and gas giant will be twice as large as rival Exxon, Shell Chief Financial Officer Simon Henry told reporters, and will be the biggest global player in natural gas.

One of Shells deepwater oil drilling, storage and offloading vessels in Parque das Conchas, Brazil. ©Shell

The deal represents a bold bet that China and other developing economies will switch from coal and oil to gas, to cut air pollution. The acquisition also brings Shell some of the largest deepwater oil fields in Brazil. The companies said regulatory issues in a number of countries could push completion of the deal to 2016.

Shell won’t see the benefits of the merger immediately: Shell’s B shares, which were used to finance the deal, took a hit on the merger news, falling 8.7 percent in trading on the London Stock Exchange on Wednesday, the biggest decline in the company’s shares in a single day since 2008. Shell’s A shares dropped 5 percent and BG shares rose as much as 43 percent in trading. The deal includes a break fee of $750 million pounds.

Economists speculate that the Shell-BG Group deal might set off a wave of mergers and acquisitions in the energy sector. Deal volume has fallen as oil prices have dropped from over from $100 per barrel in June to less than $60 today. Overall, first quarter mergers and acquisitions activity has been brisk. If it continues at the current rate, the deal volume for the year would total $3.7 trillion, the Wall Street Journal reports, making it the second biggest year for mergers and acquisitions in history.

Nearly empty reservoir at Uvas Creek in Santa Clara, California, February, 2014. ©Ian Abbott

Mapping California’s Water Consumption

In the wake of California Gov. Jerry Brown’s pledge to cut water use by 25 percent across the state, The New York Times has a useful interactive map plotting just where California’s water goes. Toggling between three screens, the map shows readers the proposed cuts district by district, the change in water consumption over time, and the heaviest usage districts per capita. Just one problem: The map focuses on community water use, while many argue that only changes to the state’s agricultural industry will offset California’s water problem—not policing individual use.

This entry was posted on Friday, April 10th, 2015 at 1:00 pm. It is filed under Week in Review and tagged with California drought, Greek debt, Shell merger, YouTube subscription service. You can follow any responses to this entry through the RSS 2.0 feed.

Comments are closed.