By Alexis Fitts May 22, 2015

Takata Issues Airbag Recall

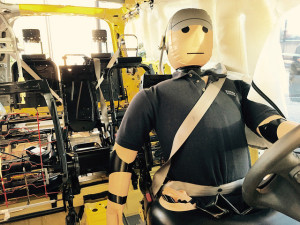

Crash test dummy ©Todd Lappin

After weeks of deflecting criticism, Japanese auto supplier Takata admitted to massive defects in its airbags on Wednesday. The airbags, which contain a mechanism that explodes on impact, have been linked with six deaths and over 100 injuries. American regulators were fining the company as much as $14,000 per day for not complying in the investigation. Following the admission, Takata doubled their recall of automobiles to 34 million, in what will be the largest auto recall in history. Last week, Toyota, Nissan and Honda recalled 11.5 million vehicles with the faulty airbags.

Now, the question is whether Takata will be able to survive this flub. On Wednesday, the company’s shares lost 12 percent of their value in trading in Japan. In the last fiscal year, Takata tallied the costs of recalls at 60 billion yen, or about US$499 million. But total costs could soar to over $250 billion—and that’s just the sum associated with fixing the faulty vehicles. Takata accounts for a quarter of the market for airbags, a market which now seems up for grabs. Both Sweden’s Autoliv and Japan’s Daicel have announced plans to increase their production to steal business from Takata, while it fixes the problematic airbags.

YouTube’s Questionable Child Practices

On Tuesday, a staff attorney for Georgetown Law’s Institute for Public Representation filed a complaint with the Federal Trade Commission against Google, arguing that its YouTube Kids app contains controversial advertising targeted towards children. Described when it was released in February as “the first Google product built from the ground up with little ones in mind,” the app is targeted towards children, yet mixes content and advertising in a way that wouldn’t be permitted in youth-centered programming on network or cable television.

On television, programs targeted towards children have to contain more obvious ways of labeling advertising, since children are less likely to be distinguish between programming and advertising. One of these techniques television use is called “bumpers,” which are five-second segments that signal that a show will be right back, which are manded between programs and commercials on television. Yet YouTube, since it’s not regulated, is able to show content in an uninterrupted stream, including content by advertisers. McDonald’s, for instance, has its own channel on YouTube Kids, with a video starring Mythbusters’ Grant Imahara on the manufacturing of a chicken nugget. Though a small label in the corner marks that the content is promotional, most children would be unlikely to understand what this means.

Los Angeles Goes for $15

On Tuesday, Los Angeles city council voted to implement a $15 per hour minimum wage, in a 14-1 vote, the largest city so far to increase its minimum wage. Under the proposal, LA minimum wage would rise to $10.50 in July of 2016, increasing each year until it reaches $15 in July of 2020. Small businesses, with 25 or fewer employees, would received a modified schedule, with increases starting in July 2017 and minimum wage reaching $15 in July of 2021. California minimum wage is currently $9, while federal minimum wage has remained stagnated at $7.25 since June of 2009.

Responding to “Fight for $15,” the organization of low-income workers advocating to increase standard wages, two other US cities have approved similar measures. In June of 2014, Seattle voted to implement a $15 minimum wage by 2017, while San Francisco plans to increase its minimum wage to $15 by 2017.

Yet, both Seattle and San Francisco’s populations are under one million; Los Angeles is a city of more than 3.88 million. Leadership in New York and Chicago have suggested that they may consider a minimum wage raise. Los Angeles, therefore, will be a case study in whether these economic policies can be enacted at scale.

Banks Plead to Criminal Charges

Global currencies ©Philip Brewer

For American banks, trading in foreign currencies is ripe for exploitation—since such trades aren’t monitored by any federal oversight committee. After the 2008 recession, domestic banks increased such trades, conspiring openly with one another to fix rates in the poorly regulated market, occasionally even in chat rooms named “the cartel” and “the mafia.”

On Wednesday, Attorney General Loretta Lynch announced that four banks—Citigroup, JPMorgan Chase, Barclays, and the Royal Bank of Scotland—pleaded guilty to felony criminal charges of manipulating foreign exchange markets. The banks will pay $5.6 billion in fines, but the felony charges seem to be little more than a symbolic punishment.

“Although they could be technically barred by American regulators from managing mutual funds or corporate pension plans or perform certain other securities activities,” wrote The New York Times “the banks have obtained waivers from the Securities and Exchange Commission that will allow them to conduct business as usual.” The cases weren’t pursued until after the S.E.C. had created the waivers. Still, the Justice Department is considering pursuing charges against individuals involved in the scheme, which may take a form more closely resembling a criminal punishment.

Grabbing Control of the Arctic

In Bloomberg BusinessWeek, writer Monte Reel has the story of the HMS Erebus, a sunken British navy ship, lost during a failed 1845 quest to find the Northwest Passage through the Arctic. The ship’s’ location eluded searchers for over 150 years, but a Canadian-financed expedition recovered it last September. Where Erebus failed, it might succeed today. As climate change melts chunks of sea ice permanently, Erebus’ original route has opened up to small ships during the summers.

“An open route can cut thousands of miles off of trips between the west coast of the Americas and Europe,” writes Reel. “But it raised an unanswered question in maritime law: Who really controls the waters of the route and the rest of Canada’s Arctic archipelago, which consists of more than 30,000 islands?” With the recovery of the Erebus, Canada hopes it can link itself to England’s maritime sovereignty over the Northwest Passage. The recovered ship provides a powerful piece of evidence that the Canadian government believes solidifies this historical relationship.

This entry was posted on Friday, May 22nd, 2015 at 6:02 pm. It is filed under Week in Review and tagged with $15 minimum wage, currency market manipulation, HMS Erebus, Takata, YouTube. You can follow any responses to this entry through the RSS 2.0 feed.

Comments are closed.