By Jackie Faye July 3, 2015

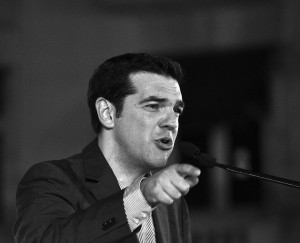

Alexis Tsipras, prime minister of Greece since January 2015 and leader of left wing Syriza party. ©Asteris Masouras

Greece Defaults

It was the first time in history a developed nation has defaulted on an International Monetary Fund loan. After weeks of tense negotiations with its creditors, Greece missed a crucial payment to the IMF on Tuesday, putting delivery of the rest of its bailout package in jeopardy and throwing its chances for remaining a member of the euro zone into doubt.

Although both sides have claimed they want Greece to remain within the European Union, experts say an exit seems increasingly likely.

Prime Minister Alexis Tsipras shut down the banks and installed strict capital controls after panicking Greeks starting emptying their bank accounts, but Athens reopened almost 1,000 banks for three days so elderly retirees could remove up to 120 euros ($133) from their pension funds. Greeks who are not retired can withdraw up to 60 euros a day for each credit or debit card they own.

In an opinion piece published by the Financial Times, a group of high profile economists voiced their support for Greece’s ruling anti-austerity party, including Joseph Stiglitz, Thomas Piketty and Marcus Miller. Headlined, “In the final hour, a plea for economic sanity and humanity,” the op-ed argued that the fate of the European Union depends on the ability of Greece and its creditors to come up with a compromise.

Puerto Rico’s Debt Woes Mount

Alejandro Garcia Padilla © Alejandro Garcia Padilla -cropped” by United Satates Department of Labor derivative work: Coronades (talk) – Secretary of Labor Hilda L. Solis meets with Senator Alejandro Garcia of Puerto Rico.jpg. Licensed under CC BY 2.0 via Wikimedia Commons.

Some are calling Puerto Rico America’s Greece after Governor Alejandro Garcia Padilla said the territory’s roughly $73 billion debt is not payable.

“In both cases, a semi-sovereign, economically uncompetitive entity finds itself mired in slow growth but enmeshed in a currency union with a far larger and stronger neighbor,” writes the Washington Post. “Both places have been enabled to live beyond their means by years of artificially easy credit — in Puerto Rico’s case, due to U.S. laws making its bonds ‘triple tax-free.’”

Unlike Greece, however, Puerto Rico did not miss its payment deadline this week—it delivered the $1.9 billion due on Wednesday. The cash-strapped U.S. territory is on a path to restructuring and Padilla has set up a group of experts to negotiate a debt moratorium with bondholders.

Even though Puerto Rico is a U.S. territory, it does not have access to Chapter 9 bankruptcy, which is reserved for cities and other municipal governments. The island’s local governments are also excluded from Chapter 9 because Puerto Rico is not a state, and the law defines a municipality as an instrument of the state.

But the territory is subject to other U.S. laws, such as minimum wage provisions. When the minimum wage rose to $7.25 an hour, deep job cuts followed on the island.

You’re Fired: The Donald Eats His Famous Words

Donald Trump © Gage Skidmore

Donald Trump was dumped by Macy’s this week over derogative remarks he made about Mexican immigrants when he launched his presidential campaign in mid June. Macy’s is the fourth company to cut business ties with the presidential hopeful in recent weeks.

“When Mexico sends its people they aren’t sending their best…they are bringing drugs, they’re bringing crime, they are rapists and some good people but I speak to border guards and they tell us what we’re getting,” Trump said when announced his candidacy from Trump Tower in New York City.

On Wednesday, Macy’s announced it would pull Donald Trump merchandise from its shelves, stating that the company “stands for diversity.” New York City, Trump’s home, is also reconsidering contracts it has with the business tycoon.

Last week, television giants NBC Universal, Univision and Televisa all announced that they were ending their relationships with Trump, and would not air the Miss USA or Miss Universe pageants, which are co-owned by Trump. Mexico’s pageant director has also said Mexico will not send a contestant to the Miss Universe contest because of the insulting remarks. Trump turned around and filed a $500 million dollar lawsuit against Univision for backing out of its contract.

Meanwhile, Trump refuses to back down. He has said he stands behind his comments about illegal immigration in this country.

Export-Import Bank Expires

U.S. Capitol. ©Brandi Korte

The charter for the Export-Import Bank, or Ex-Im, expired for the first time since it was created in 1934. The Republican-controlled Congress failed to vote to authorize the bank to continue operating before recess.

Ex-Im helps U.S. companies export their wares around the world by providing loans and credit insurance to American companies operating abroad that can’t get funds from private lenders. In the past six years, the bank has backed the sale of more than $200 billion in U.S exports, supporting 1.3 million American jobs. Small government conservatives oppose the bank on the grounds that it interferes with the free market.

With its charter expired, the bank is unable to make new loans for now. However, bank officials told the Associated Press that Ex-Im, “will stay in business for the time being to service more than $100 billion in outstanding loans and guarantees, and no immediate lay-offs or changes are planned.”

Toyota Executive Resigns After Just 90 Days

Oxycodone ©Be.Futureproof

Toyota’s first female executive, Julie Hamp, 55, is in jail and out of a job just 90 days after joining the Japanese automaker. The former chief communications officer offered her notice from a Japanese jail after authorities say they found oxycodone pills in a package she mailed to herself in Japan.

Hamp was recently promoted as part of Toyota’s effort to diversify its executive suite. She was the highest ranking women and one the most senior executives who was not Japanese. Toyota said in a statement that it “accepted her resignation after considering the concerns and inconvenience that recent events have caused our stakeholders.”

Japan has strict drug laws that do not allow foreigners to bring prescription pills into the country without significant documentation. Police can hold Hamp in jail until July 8 before deciding on whether they will press charges.

Jeff Kingston, professor of Asian Studies at Temple University’s Japan campus in Tokyo said that Hamp’s treatment by the police and local media “sends a chilling message to other foreign managers who might be considering a posting to Japan.”

Ace Buys Chubb in World’s Largest Insurance Deal

In one of the biggest acquisition deals of the year and the largest ever between two companies in the insurance industry. Ace Ltd. Announced this week it is buying Chubb Corp. for $28.3 billion in cash and stock. The deal will create one of the biggest property-casualty insurance companies in the world.

Chubb, based in New Jersey, is a leading provider of homeowners’ insurance to wealthy Americans. Ace’s personal-insurance business also caters to high earners. Both companies also sell insurance to midsize businesses.

Combined, the two have net written premiums worth more than $30 billion and employ more than 31,000 workers globally.

This entry was posted on Friday, July 3rd, 2015 at 5:18 pm. It is filed under Week in Review and tagged with Ace Chubb insurance deal, Alejandro Garcia Padilla, Alexis Tsipras, Donald Trump, export-import bank, Greek bailout, Greek default, Julie Hamp, Macy’s, NBC Universal, Puerto Rico debt, Televisa, Toyota, Univision. You can follow any responses to this entry through the RSS 2.0 feed.

Comments are closed.