By Kim Gittleson June 6, 2016

David Rubenstein, World Economic Forum. © Monika Flueckiger / World Economic Forum, swiss-image.ch, CC BY-SA 2.0

In his March 2016 story “The Billionaire’s Loophole,” published jointly by The New Yorker and ProPublica, journalist Alec MacGillis investigates the connection between tax breaks for carried interest—the controversial “loophole” of the title—and the philanthropy of the very rich. Ongoing debate about that loophole is a subject MacGillis covered extensively during his time as a reporter for the Washington Post. MacGillis chose as his primary subject private equity titan David Rubenstein, who has pushed hard to keep the loophole through lobbyists for his firm The Carlyle Group, and also made significant philanthropic contributions that have a “patriotic” focus. The argument MacGillis ultimately makes is that this particular tax break ends up allowing the top one percent of the one percent in the U.S. to take on the project of governing our democracy and supporting social programs according to their private whims rather than a public mandate, while hobbling the elected government’s ability to do it’s job—that the loophole essentially undermines democracy. The story has generated a storm of commentary and debate since it was first published.

Knight Bagehot fellow Kim Gittleson spoke with MacGillis about his reporting and writing process in a Q&A and with annotations to the piece itself, included below, with permission from The New Yorker and ProPublica.

Kim Gittleson: Where did the idea for this story originate?

Alec MacGillis: I’ve really been thinking about this general idea for a couple years now and I think it came from two different places. It came from, on the one hand, watching this endless debate about the carried interest loophole, which I was writing about going way back to 2007 when I was at the Washington Post. So [it came from] covering it all those years and wondering, my goodness, how is it that loophole has still not been closed even with Democrats in power and even with more recognition of its basic unfairness across the political spectrum?

At the same time, another motivation was seeing all this philanthropy happen—especially the philanthropy of David Rubenstein—and having some inkling of the fact that he and his firm had some role in preserving the loophole. So I was struck by the fact that there’s no real connection being made between the loophole, and the lobbying to preserve it, and this philanthropy. There was this disconnect between those two stories: the stories about the philanthropy never made mention of the loophole, when in fact one and the same person was helping preserve this loophole that we all had decided was pretty unfair and untenable. I was struck that the same person was making these big gifts and somehow we weren’t making that link.

KG: How did the collaboration between ProPublica and The New Yorker come about? Did you know from the start you were reporting a piece for The New Yorker?

AM: The way it usually works with ProPublica with our bigger pieces is that we look for partners to co-publish the pieces with—that’s been the whole approach from the start for ProPublica. They produce these stories and they look for publications that would be a good fit. In this case, we had a couple ideas for possible partners but I thought that The New Yorker would be a good fit because, well, obviously it’s a great magazine—but beyond that there’s something about this piece that struck me as a good New Yorker piece. It had these profile elements—they like to run a lot of good profiles—and it’s also a piece about the nexus between Wall Street and Washington and that also just struck me as being in a New Yorker vein. And I wanted to go there with it because I had published a piece there about a year before and I knew I would have a good experience with them.

KG: Was the piece always going to be focused on David Rubenstein? Or did you want to first focus on the tax loophole and you ended up choosing Rubenstein as the poster boy for it?

AM: I’d definitely been thinking about it around the figure of Rubenstein even though of course there are other private equity titans who have benefitted a lot from the loophole and have made a lot of money and donations. Steve Schwarzman has made even more from the loophole than Rubenstein, and has also given a lot of money on the side—to the New York Public Library, for instance.

I also found him more interesting and relevant for the “patriotic” focus of his philanthropy. The fact that he’s giving to all of these Washington institutions really brings it into focus in a way that more traditional conventional philanthropy doesn’t bring into focus the tension between philanthropy and taxation in government. That you have this person who would be paying more taxes were it not for the loophole who is instead giving money to support these public buildings and institutions like the Washington Monument on the explicit logic that “We should help out because the government doesn’t have enough money to pay for itself any more”—the irony was pretty rich.

KG: Were you surprised that David Rubenstein didn’t want to speak with you? How difficult was it to report around him?

AM: I tried many, many times to get an interview with him…I did manage to get that one quote from him, which came after the awards ceremony at the Carnegie lunch. I managed to just grab him for a few seconds after the lunch but I was not able to have a real bona fide interview with him. I would have been very glad to get the chance to ask him what he thinks about this tension between his philanthropy and paying less taxes. He’s spoken out several times since the piece appeared on CNBC and Marketplace and he’s very staunchly defended the notion that he can spend the money better on his own than the government could. It would have been great to hear him out on that and hash it out with him.

KG: What were the biggest challenges you faced in reporting?

AM: It was definitely a real slog to get the inside story of how the loophole had been preserved at these various key moments on the Hill—to get those lobbyists and Hill staffers to open up on that. Then finally it was definitely a writing challenge to make clear to readers, or to your average reader, what the loophole is all about and how it came to be and to get across its essence without losing people in the intricacies of tax law.

KG: How crucial were tax filings and other paper trails in your reporting?

AM: This is one of those cases where it really helps to have people who are far more informed than you who can help you work through the numbers. Like a Victor Fleischer [the main professor whose research is cited in the piece] who has been working on this for years and years and who has almost made it his life’s work. He has become very good at explaining to journalists and lawmakers just how it all works and what it boils down to.

KG: What has the reaction to the piece been? Were you surprised?

Alec MacGillis

AM: It was a strong reaction. It was very heartening that despite the fact that generally tax law is not necessarily the sexiest of subjects, there was a lot of gratitude from people who have always heard about the loophole but never really understood it, so people were grateful to finally have it laid out like that. Then there was gratitude from people who do understand the loophole and know how fundamentally unfair it is but hadn’t seen it covered this way.

I also heard from people who really had their minds changed on the whole issue of how they thought about large-scale Gilded Age philanthropy. The piece caused them to reassess how they thought about that—to no longer look at these massive gifts as unalloyed good news.

I did hear from people in the industry who have come to see it [the tax treatment of carried interest] as indefensible and they were just very glad to see the piece because it was laying out for the larger world why it is indefensible. But the fact is, as indefensible as many now think it is, [the loophole] is going to continue. It’s going to be at least another couple years.

KG: That brings me to my last question. Do you think there is any real political will to close this loophole? Do you see that happening under the next president?

AM: The only way one can see it now changing in 2017 would be if there were a Democratic sweep—an unforeseen Democratic sweep—of the House. That is highly unlikely and if the Republicans remain in control of the House there is no indication that they will take up a specific legislation like Congressman [Sandy] Levin’s fix for the carried interest loophole. The party line has become that [the carried interest loophole] will be taken up in comprehensive tax reform. But it’s very hard to imagine right now how fundamental tax reform is going to happen given that it’s something we haven’t been able to do since 1986. It requires a semi-functional Washington in the best of times—it’s such a bear of a project to take on with so many different interests lobbying for their stake. And given this Congress…the notion of comprehensive tax reform just seems very remote…It’s become a very handy line to say “yes, we know this is not tenable but don’t worry we’ll get rid of it when we fix the whole tax code.”

The Billionaire’s Loophole

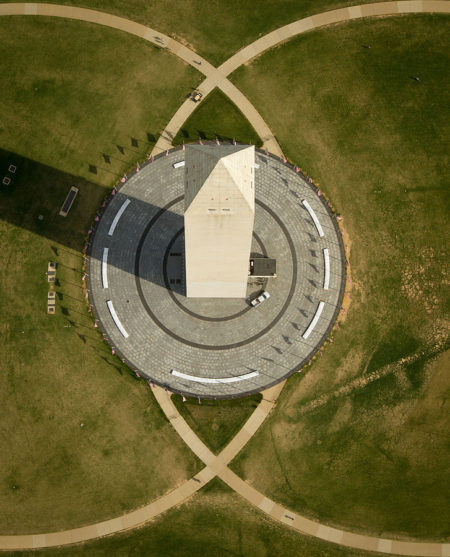

Washington Monument from above. © By NASA/Bill Ingalls, Public

On August 23, 2011, a magnitude-5.8 earthquake shook the Washington Monument for about twenty seconds, sending tourists on the observation deck down eight hundred and ninety-seven steps. One of the two strongest quakes ever recorded east of the Rockies, it fractured two dozen of the stone protrusions that hold up the marble slabs at the monument’s peak. That December, Congress appropriated half of the fifteen million dollars required to repair the obelisk, saying that the rest would have to be raised from private citizens. KM: I loved the drama of this opening – there is almost no more perfectly potent symbol of political power in the U.S. The monument is like a stand in for Rubinstein, “civic patriarch.” On the other hand it happened five years ago…did you consider starting with something more recent? What other openings did you consider and how did you decide to start here? AM: I considered other openings, such as Rubenstein’s acceptance of the Carnegie Medal and the private salons at the Library of Congress, but pretty quickly settled on the Monument, both because it is such a prominent symbol of his “patriotic philanthropy” and because his humorous riff about signing his name to the monument unintentionally gets at some of the tensions around our growing reliance on the very wealthy for even public spaces and institutions like the Monument.

Within weeks, David Rubenstein, the co-founder of the Carlyle Group, a private-equity firm, announced that he would provide the funds. On June 2, 2013, Rubenstein joined the Secretary of the Interior and the head of the National Park Service to inspect the progress, atop the scaffolding. In public appearances, he often tells what happened next, in a deadpan manner that he says is joking. As he recalled last year in a talk at Rensselaer Polytechnic Institute, he decided, while his hosts were looking away, to leave his mark: “I took a pen out and I wrote my initials at the very top.”

Rubenstein, with an estimated net worth of $2.6 billion, is one of the wealthiest people in Washington. He is an American-history buff, and practices what he calls “patriotic philanthropy,” on behalf of the national heritage. In 2007, he spent $21.3 million on a seven-hundred-and-ten-year-old copy of the Magna Carta. He loaned it to the National Archives and, four years later, financed the construction of a new, $13.5-million gallery to house the document. He has bought two copies of the Emancipation Proclamation, signed by Abraham Lincoln, and loaned one to President Obama, who displayed it for a time in the Oval Office. He has made substantial gifts to Monticello, to James Madison’s estate at Montpelier, to Robert E. Lee’s mansion, to the Iwo Jima Memorial, and, last month, to the Lincoln Memorial. (Although he has also donated generously to hospitals, universities, and other traditional beneficiaries, more than half of the several hundred million dollars he has given away fits the “patriotic” theme.)

His role as a civic patriarch extends to other projects. He is the president of the Economic Club of Washington, which brings together the city’s business élite for discussions with government and financial leaders, and he sits on the boards of the Kennedy Center, the Brookings Institution, and the Smithsonian. Every few months, he funds a bipartisan dinner salon for senators and representatives at the Library of Congress, where he interviews a prominent Presidential historian, such as David McCullough, Ron Chernow, or Doris Kearns Goodwin.

In 1987, after a short career in politics, Rubenstein founded Carlyle, building it around his Washington relationships and those of his partners—“access capitalism,” Michael Lewis called it, in a critical 1993 profile of Rubenstein in The New Republic. For the most part, Rubenstein has received favorable press coverage, including widespread praise for his charitable work. In 2012, the Washington Post described him as the “generous repeat benefactor for Washington’s endangered national icons,” and the magazine Washingtonian named him a Washingtonian of the Year. He is a frequent guest on Bloomberg Television and on CNBC. Last May, on a “60 Minutes” segment titled “All-American,” he said, referring to the Washington Monument, “The government doesn’t have the resources it used to have. We have gigantic budget deficits and large debt. And I think private citizens now need to pitch in.”

Until recently, relatively little attention had been paid to one source of Rubenstein’s wealth, which he has quietly fought to protect: the so-called carried-interest tax loophole. KG: We are well into the story before you get to this – though it’s ostensibly the main thrust of the piece. Why did you wait to introduce the concept? AM: We wrestled with whether this was too low to introduce the actual loophole but decided it was not. After all, the piece is about both the loophole and its intersection with philanthropy in the Second Gilded Age; we decided to lead with the philanthropy for the reasons described above and because it allowed us to then shift to the loophole as, in essence, a reality check on the image offered in the lede. Let’s face it, leading with the tax loophole itself may have lost some readers. Also, I knew that the loophole would be mentioned somewhere in the title of the piece; there’d be little doubt what the piece was about. The tax break has helped private equity become one of the most lucrative sectors of the financial industry. Since the end of the recession, private equity has reported record profits, and at least eighteen private-equity executives are estimated to be worth two billion dollars or more each. And during the current Presidential campaign, with its populist themes, the loophole has become a target among Democrats and Republicans alike.

The notion of “carried interest” derives from the share of profits that twelfth-century ship captains received on the cargo they carried. It came into its modern usage in the nineteen-twenties, in the oil-and-gas industry, and was enshrined in the federal tax code in 1954. When a group of partners drilled for oil, a few would put up the money and others would invest only their labor, or “sweat equity”—finding land and investors, buying equipment, and so on. If the partners sold out, the I.R.S. would tax the profits of all the partners at the lower rate for capital gains rather than as ordinary income.

Even if no profits are realized, private-equity firms get paid: under the “2 and 20” compensation structure, they receive a two-per-cent fee annually on assets under management, in addition to a twenty-per-cent cut of profits beyond a given benchmark. The I.R.S. characterizes the managers’ cut of the profits as carried interest, taxing it as though it were capital gains made through the sale of a person’s own investment. For most of the past fifteen years, long-term capital gains have been taxed at fifteen per cent, compared with thirty-five per cent for ordinary income in the top bracket.

One name for the tax break is the “hedge-fund loophole,” but hedge funds benefit much less than private equity does, because their trades tend to be too short-term to qualify for the low capital-gains rate. At a Credit Suisse forum in Miami, in 2013, Rubenstein said of private equity, “Carried interest is really what the business has historically been about—producing distributions for your investors from good sales and I.P.O.s . . . and getting twenty per cent of the profits for yourself.” He went on, “That’s how we’ve really grown our business.”

Barack Obama, during his first Presidential campaign, pledged to reform the tax on carried interest and, in 2012, went after Mitt Romney for having enjoyed its benefits as the co-founder of Bain Capital. This year, Bernie Sanders, Hillary Clinton, and Donald Trump have all attacked the loophole, often using hedge-fund managers as the rhetorical target. As Trump put it in August, “They’re paying nothing, and it’s ridiculous. . . . These are guys that shift paper around and they get lucky.” Jeb Bush, who made a foray into private equity in 2014, also called for closing the loophole during his ill-fated campaign.

Private-equity partners argue that their tax treatment is justified under the tradition of encouraging risky business partnerships and is necessary for their industry to flourish. So far, the partners have won out: despite the rise of anti-Wall Street sentiment after the 2008 financial collapse, the loophole has withstood every effort at reform.

David Rubenstein, who is sixty-six, grew up in Baltimore, in a two-bedroom row house in the city’s northwestern corner, which was then predominantly Jewish. His father sorted mail for the postal service, and his mother was a homemaker. As a student at City College, a premier, boys-only public high school, Rubenstein was serious-minded and kept to himself. “He was very, very quiet,” his fellow-student Kurt Schmoke, who, in 1987, became the city’s first elected black mayor, told me. “He liked to talk about government and politics—not so much about business.” KG: How did you dig up these background details on Rubenstein? How did you find Schmoke? At what point did you realize that Rubenstein was not going to participate? AM: There’s been a fair amount written on Rubenstein’s upbringing in past pieces about his business success; he talks very freely about his humble Baltimore roots. I live in Baltimore and actually drove up to check out his old neighborhood, which has transformed to being almost completely African-American. I actually met with Kurt Schmoke for another piece I was working on, about Baltimore, but tacked on a few questions about Rubenstein at the end. I very much hoped to interview Rubenstein himself, but was told early in my reporting by the Carlyle spokesman that he would not participate in this piece. I did manage to get a few minutes with him at the end of the Carnegie Medal ceremony.

In 1975, after graduating from Duke and then the University of Chicago law school, and spending two years at the corporate law firm Paul, Weiss, in New York, Rubenstein served as the counsel to Senator Birch Bayh, Democrat of Indiana, on the Subcommittee on Constitutional Amendments. A year later, at the age of twenty-six, he joined Jimmy Carter’s Presidential campaign as a policy aide and was subsequently hired as a deputy to Stuart Eizenstat, President Carter’s domestic-policy adviser. Rubenstein helped write memos for Carter, prepare him for press conferences, and draft State of the Union addresses.

At the White House, Rubenstein subsisted on vending-machine snacks, staying late enough to get his briefing papers at the top of Carter’s stack. KG: Wonderful details. AM: Yes, came across this in one of the older profiles of Rubenstein. A trick that many a West Wing grind would appreciate. “He was almost painfully shy,” Eizenstat told me. “He almost never spoke to the press. He kept his head down. He almost never spoke in meetings.” On his late shifts, Rubenstein got to know Alice Rogoff, an assistant to the director of the Office of Management and Budget, when she came by to drop off memos. They married in 1983; Rogoff is now an arts philanthropist and the owner of the Alaska Dispatch News, the state’s largest newspaper. (She lives part time in Anchorage.)

Rubenstein was crushed when Carter lost to Ronald Reagan, in 1980. “I tried to help my country, and it didn’t work,” he told the Washington Post years later. In 1981, he took a job in the mergers-and-acquisitions group at the Washington-based law firm Shaw, Pittman, Potts & Trowbridge, but he soon started exploring a career change. Legal work bored him, and he was in touch with friends from his days at the White House who were prospering in business. “I realized I was going somewhere that wasn’t going to take me where I wanted to be,” he said at Rensselaer.

Over time, partnerships in other industries, mainly real estate and venture capital, began taking advantage of the same form of taxation. Private-equity firms stretched the model to its breaking point. Their work is essentially a combination of investment banking and management consulting: they are compensated not for building new ventures from scratch, with the risk that entails, but for managing the investments of wealthy individuals and pension funds and other institutional clients. These funds are pooled, along with borrowed money, to acquire private companies or to take public companies private—before making improvements or cutting costs and selling at a big profit.

At that time, the first “leveraged-buyout firms,” as private equity was then called, were springing up in New York and Boston, led by groups such as Bain Capital and Kohlberg Kravis Roberts. Rubenstein decided to apply to this line of business what he’d learned in Washington about lobbying. Nobody in private equity had yet thought to choose partners chiefly on the basis of their relationships with government officials and their knowledge of regulated industries. KG: Seems like ‘crony capitalism’ defined. AM: indeed. Gary Shapiro, then a lobbyist for the consumer-electronics industry who worked alongside Shaw, Pittman in one lobbying fight against Hollywood, recalls hearing Rubenstein’s pitch when they travelled together to Japan, in the early eighties: “His vision was to combine capital with politically connected people whose phone calls are accepted around the world. We laughed at him, like, Yeah, right.” KG: How difficult was it to dig up sources like Gary Shapiro who, it sounds like, did not know Rubenstein all that well, but clearly had an interesting anecdote to tell. Were there many who would not talk to you? At any point did you think you might not be able to tell this story without Rubenstein’s participation? AM: I came across Shapiro in one of the earlier pieces about Rubenstein’s success in business, recounting Rubenstein’s move into private equity in the ‘80s, and reached out to him to get him to expand on that. He was very helpful. I was aware that I’d need to get as many people as I could who’d worked with and near him over the years to fill in gaps that were left as a result of his decision not to participate in the piece. But I’d have reached out to many of them even if he had participated; it’s always good to get other perspective and voices.

In 1986, Stephen Norris, a lawyer for Marriott, learned of a change to the federal tax code recently initiated by Senator Ted Stevens, Republican of Alaska. It allowed Alaska Native corporations, created under the Alaska Native Claims Settlement Act, to sell their paper losses at a discount to companies that could use them to reduce their own taxes. Norris started a business that matched companies with Native Alaskans and persuaded Rubenstein to leave Shaw, Pittman and join him. In a single year, they brokered the transfer of a billion dollars in losses, earning at least ten million dollars in fees. In 1987, they were on the verge of another big transfer when the government closed that loophole. The episode became known in Washington business lore as the Great Eskimo Tax Scam. KG: I’m fascinated by this –“patriotism” can take such interesting forms. AM: It is pretty striking that, years before the carried-interest loophole became so lucrative for Carlyle, the fledgling firm’s big success involved exploiting a different loophole in the tax code.

In September of that year, Rubenstein founded the Carlyle Group, with Norris; Dan D’Aniello, of Marriott; and William Conway, of the telecom giant M.C.I. The firm was named for the New York hotel, to evoke old-money grandeur. The partners soon brought in Frank Carlucci, Ronald Reagan’s final Secretary of Defense. Fred Malek, the former deputy chairman of the Republican National Committee, did consulting work for the firm.

Carlyle struggled in its first several years, making an unsuccessful venture into airline food, with Caterair, and losing a bid for the restaurant chain Chi-Chi’s. In 1990, though, the focus on Washington paid off. Thanks mainly to Carlucci, Carlyle was able to buy B.D.M., Ford Aerospace’s defense consultancy, which was the first of many military-industrial investments. (Seven years later, having expanded B.D.M.’s operations into Saudi Arabia, Carlyle sold the consultancy, making a six-hundred-and-fifty-per-cent profit.)

Two members of the George H. W. Bush Administration, Richard Darman, the budget director, and James Baker III, the Secretary of State, joined Carlyle when they left the government. In the late nineteen-nineties, the ex-President himself came on board and helped position the firm to win a bidding war for one of South Korea’s top banks. The firm branched out into new industries, buying ownership stakes in Dunkin’ Donuts and Hertz, among many others.

In 2007, Carlyle’s twentieth anniversary, the firm managed seventy-five billion dollars in assets, and Rubenstein made his début on the Forbes 400 list. By 2009, Carlyle’s portfolio included $1.5 billion from the New York State pension fund. According to an investigation that year by Andrew Cuomo, then the state attorney general, the pension money had been obtained in part through improper payments to middlemen by a Carlyle affiliate. Though Carlyle was not accused of any wrongdoing, it agreed to pay twenty million dollars to resolve the matter.

Over the years, Rubenstein’s Democratic allegiance has loosened. In 1990, Carlyle put George W. Bush, who had just left the oil business in Texas, on the Caterair board. In the late nineties, Rubenstein and Rogoff still hosted the Carters at their Nantucket vacation home, but they more often socialized with George and Barbara Bush. In 2000, Rubenstein, Rogoff, and their three children (two daughters and a son, now grown) accompanied Barbara Bush and her grandchildren on a safari. That same year, Rubenstein and Rogoff attended Barbara Bush’s seventy-fifth-birthday party, in Kennebunkport.

Rubenstein has admitted that his relationship with the Bush family affected his politics, but he also developed strong ties with the Clinton Administration. In 2001, Carlyle hired two former Clinton officials—the chairmen of the Federal Communications Commission and the Securities and Exchange Commission. For years, Rubenstein has refrained from contributing to political campaigns, and Carlyle has never formed a political-action committee. Rubenstein told Reuters in 2012, “I don’t really try to get involved politically by giving money to politicians or by saying I’m a Democrat or Republican. Right now, I just view myself as an American.” Last year, when President Obama visited Anchorage, he had dinner with Rogoff at her home.

Rubenstein, who declined to participate in this story, has long since overcome his shyness. KG: Why did you wait until this point to mention Rubenstein declined to participate? AM: We went back and forth on where to mention it. It was more a matter of finding a place to mention it gracefully, without interrupting the flow of the piece, than anything else. “David’s evolution is really like a butterfly coming out of a cocoon,” Eizenstat told me. During Rubenstein’s first appearance on the Charlie Rose show, in 2006, with Stephen Schwarzman, the co-founder of the Blackstone Group, another private-equity firm, he was asked to name the “most dynamic industry” to invest in. Dryly, he responded, “Other than the private-equity industry?” He went on, “The private-equity industry has become an industry by itself, as you know. The firms like Steve’s and ours and others have become quite large.” He held his hands apart to suggest this remarkable growth.

In 2012, when Carlyle made its first offering of public stock, it reported that Rubenstein, D’Aniello, and Conway—Norris departed in 1995—had been paid about a hundred and forty million dollars each the previous year, an amount that dwarfed the pay of nearly all top C.E.O.s that year. (Jamie Dimon, of JPMorgan Chase, made twenty-three million dollars.) They had also received significant returns on their own investments in Carlyle funds: Rubenstein collected fifty-seven million dollars, D’Aniello seventy-eight million.

Of that hundred and forty million in pay, a hundred and thirty-four million came from the firm’s share of its investors’ profits. The filings make it difficult to determine the exact distribution, but industry experts say that at a large firm like Carlyle three-quarters of a partner’s pay typically comes out of carried interest. By that calculation, the loophole would have saved the partners about twenty million dollars each, in 2011 alone. Over the next four years, each partner’s savings would have amounted to more than fifty million dollars.

In 1889, Andrew Carnegie published “The Gospel of Wealth,” his Gilded Age manifesto. He believed that concentrated wealth was essential to capitalism, but that much of that wealth must be given away, in order to maintain a “reign of harmony” with the poor. The “duty of the man of Wealth,” he wrote, is to “set an example of modest, unostentatious living, shunning display or extravagance; to provide moderately for the legitimate wants of those dependent upon him; and after doing so to consider all surplus revenues which come to him simply as trust funds.” Those should be put toward whatever, “in his judgment, is best calculated to produce the most beneficial results for the community.” Warren Buffett and Bill Gates frequently invoke Carnegie when they speak of their Giving Pledge campaign, which commits billionaires to giving away at least half their money. A hundred and forty others have signed it, including Rubenstein, Carl Icahn, Michael Bloomberg, Mark Zuckerberg, and Elon Musk.

Like Buffett and Gates, Rubenstein has urged others to follow Carnegie’s credo. “There’s no evidence that you really need the wealth in the afterlife,” he said during his talk at Rensselaer. “I got to the point where I realized I had more money than I obviously needed, or I didn’t want to ruin my children’s life by giving them too much.”

Rubenstein prides himself on driving a fifteen-year-old Mercedes station wagon, but he does not quite follow Carnegie’s call for unostentatious living. In addition to his Nantucket compound, where thirty people can comfortably stay, he has a vacation home in Colorado, and travels in a sixty-five-million-dollar Gulfstream. His main residence, which sprawls over seven thousand square feet, sits in suburban Bethesda. Nevertheless, he’s more modest than counterparts such as Schwarzman, who in 2007 threw himself a now infamous three-million-dollar birthday party at the Park Avenue Armory, in New York, and who spends more freely in politics, especially on Republican candidates.

One afternoon last October, Rubenstein and his mother gathered with several hundred other guests at the Stephen A. Schwarzman Building, the Beaux-Arts main branch of the New York Public Library, rechristened in 2008 in exchange for a hundred-million-dollar gift. Rubenstein was there to receive the Carnegie Medal of Philanthropy, along with seven others, including Microsoft’s co-founder Paul Allen and the Utah industrialist Jon Huntsman, Sr. Rubenstein roamed around the vast Celeste Bartos Forum, hands in his pockets, with the proprietary air of a man at his daughter’s wedding.

The theme was Scottish, in honor of Carnegie, and, after a lunch of braised short ribs Balmoral and roasted tatties, Judy Woodruff, the PBS news anchor, began the ceremony. There were video clips about the recipients, narrated by Tina Fey. “Like Andrew Carnegie, Mr. Rubenstein came from modest circumstances,” she said. Before Rubenstein received his medal, Woodruff said, “His philanthropy is historic. . . . He never tires of giving back.”

Rubenstein, a square-shouldered, dough-faced man with neat white hair and tortoiseshell glasses, speaks in a rapid-fire monotone. In his acceptance speech, he said, “When I was told about this award, I thought there must have been a category for a Jewish boy from Baltimore, and that’s how I got it.” Carnegie, he said, had written him a letter from the beyond. “ ‘Philanthropy is something that anyone can do and everyone should do,’ ” the “letter” read. “ ‘Good philanthropists invariably live very long lives and when their time is up they are warmly welcomed into a special place in Heaven.’ ” On his way out, Rubenstein picked up a party favor: a sugar cookie decorated with Carnegie’s bearded visage in frosting. KG: Love this detail. Wondering how you managed to learn this? Were you following him around all night? AM: Yes, I was at the luncheon; as mentioned above, it’s where I managed to grab a few minutes with him after the event. I told him I was working on a piece touching on both his philanthropy and the loophole. Another detail that struck out to me was that he kept the medal, with its bright-red ribbon, around his neck as he walked out of the library into Midtown. It looked almost like a scarf.

The person most responsible for inspiring the movement against the carried-interest tax loophole is Victor Fleischer, a tax-law professor at the University of San Diego School of Law. Fleischer, the son of two college professors in Buffalo, became aware of the loophole in the late nineteen-nineties, when he was working as a tax attorney at Davis Polk, in New York. Fleischer does not consider himself particularly liberal. He is motivated, he told me, by a basic idea. “It’s important to think about how the tax system treats people. The tax system has to fund the government and the government has to do things for everyone.”

For more than a decade, Fleischer has argued that the loophole contributes significantly to income inequality, by inflating what he calls the “alpha income” of financiers in the top one per cent of the one per cent. In legislative circles, he is among the foremost authorities on the issue. The other side has acknowledged his expertise in its own way: early in his research, he declined a consulting gig for a private-equity lobbyist.

Before the two-thousands, the taxation of partnership income had never been cause for public debate. It became largely moot in 1986, when a tax-reform deal signed by Ronald Reagan equalized the rates for capital gains and top-bracket ordinary income. But George H. W. Bush and Bill Clinton raised taxes on ordinary income, and Clinton, in 1997, cut the tax on capital gains significantly. Five years later, George W. Bush cut rates on both kinds of compensation, and there was, once again, a big advantage in having one’s pay categorized as capital gains. And a growing industry was poised to profit from that distinction.

In 2006, Fleischer, then an untenured professor at U.C.L.A., circulated a research paper, his first on the carried-interest loophole, called “Two and Twenty.” (It was published two years later, in the New York University Law Review.) He argued that the compensation scheme in private-equity firms meant that partners were not taking the kind of risk for which the capital-gains tax was designed. “If the fund does well, the managers share in the treasure,” he wrote. “If the fund does badly, however, the manager can walk away.” He noted that some partners were even taking a portion of their management fees in the form of carried interest, to increase the tax advantage. “This quirk in the tax law allows some of the richest workers in the country to pay tax on their labor income at a low rate.”

Members of Congress aren’t known to scrutinize academic articles about tax law. But Fleischer’s report had been picked up by several economics blogs, and in 2007, as Democrats assumed control of both Houses of Congress, it circulated among tax staffers on the Senate Finance Committee. Fleischer was asked to come in and brief committee aides. Soon afterward, the chairman, Max Baucus, of Montana, and the top Republican, Chuck Grassley, of Iowa, produced a bill to close one part of the loophole, which covered the corporate taxes of publicly traded companies. It was nicknamed the “Blackstone bill,” because that firm was then preparing a $4.7-billion public offering. Senator Barack Obama was one of the bill’s four co-sponsors.

Around the same time, Sander Levin, a Michigan Democrat on the House Ways and Means Committee, learned about the loophole, at a dinner with his wife and an old law-school friend, who had become a tax attorney. “He said to us, ‘I want to give you an example of how unfair the tax code is,’ ” Levin told me. “ ‘I want to tell you about carried interest.’ ”

In June of 2007, Levin produced a more sweeping bill, which became the model for future reform attempts. He called for closing the loophole on the profits of all private-equity partnerships. The capital-gains break would still apply for those who put money at risk by contributing to a private-equity fund, including the firm’s partners, when they had invested their own money. But all income from managing the firm’s assets would be taxed at ordinary rates. The congressional Joint Committee on Taxation estimated that closing the loophole would bring the Treasury twenty-five billion dollars in revenue over ten years. KG: It’s kind of incredible how sensible this sounds, and how difficult it is to imagine how anyone could object. AM: Indeed. These private-equity partners are making tens of millions each year on their own investments in the firms and paying the low capital gains rate on that, which no one is objecting to. It makes their intense protectiveness of the break on the carried-interest they get for managing others’ money all the more remarkable.

The private-equity industry was ready. The biggest firms—Carlyle, Blackstone, Kohlberg Kravis Roberts, and Texas Pacific Group—coördinated operations through a trade association called the Private Equity Council, founded the year before. Together, the council and the individual companies retained twenty lobbying firms for the task. Blackstone spent $4.9 million on lobbying in 2007, working mainly with a team from Ogilvy Government Relations, led by Wayne Berman, a veteran Republican lobbyist. Carlyle also used Ogilvy, along with McKenna, Long & Aldridge, a smaller firm that generally lobbied Democrats.

The private-equity lobby could expect strong Republican opposition to tax increases and, among most members of the Democratic House, reflexive support for the loophole-closure bill. But there was an opening when it came to one sliver of the Democratic caucus: Finance Committee members reluctant to raise taxes on big donors in the financial centers they represented. Private-equity lobbyists focussed on Chuck Schumer, of New York, and Maria Cantwell, of Washington. Schumer had strong ties to the industry; the private-equity firm Apollo was one of his biggest donors, not far behind Bank of America.

Hillary Clinton, the other senator from New York, then early in her first run for President, said that she supported closing the loophole. At a July campaign event in Keene, New Hampshire, she evoked Warren Buffett’s famous complaint that he is taxed at a lower rate than his secretary: “It offends our values as a nation when an investment manager making fifty million dollars can pay a lower tax rate on her earned income than a teacher making fifty thousand dollars pays on her income.” Clinton, who had received almost thirteen million dollars in donations from Wall Street, her second-largest source after law firms, was not a co-sponsor of the Baucus-Grassley bill.

In the summer of 2007, David Rubenstein went to Capitol Hill to appeal to the Democrats. He visited the Finance Committee offices, according to former staffers, and met with Baucus. Rubenstein’s familiarity with Capitol Hill provided what so many others tried to acquire by means of campaign contributions: he was on a first-name basis with dozens of members of Congress. One lobbyist who visited Capitol Hill with Rubenstein told me that he has a “policy focus. He’s very cerebral, and could make an argument and articulate it. He’s a salesman.” Eizenstat said, “He’s created a sort of halo effect wherever he goes.”

During the same period, Bruce Rosenblum, a managing director at Carlyle who was then the chairman of the Private Equity Council, appeared before several congressional committees. He argued, among other things, that the industry served the economy by streamlining companies and producing investment gains for pension funds, and that raising taxes on private equity might prompt some firms to move abroad. Speaking before the Senate Finance Committee in July, he challenged the notion that private-equity partners were not true entrepreneurs: “Is creating the next Google more important than an investment to strengthen iconic American brands such as Dunkin’ Donuts and Burger King?”

In September, Rosenblum testified before the House Ways and Means Committee. Rubenstein was his implicit subject: “The relentless media and political focus on a handful of highly successful founders of large private-equity firms ignores the fact that these individuals, like many other successful business founders, were not necessarily ‘rich’ when they started their businesses.” Victor Fleischer testified at the same hearing. “The partnership-tax rules were designed with small business in mind, not billion-dollar investment funds,” he said.

Levin’s bill advanced through the House, but the Senate proposal stalled in the Finance Committee. At a September hearing, Cantwell said, “Isn’t, in an information age, access to capital even more critical than in the industrial age, as it relates to spurring more entrepreneurship?” Schumer insisted that any reform also apply to real estate and venture capital. “I want to make sure that New York partnerships are not singled out,” he said. Grassley, referring to Schumer and private-equity firms, told Bloomberg News, “They contribute most of their money to the Democratic Party, and he wants to protect the income.”

As Barack Obama began campaigning in earnest for President, he seized on Wall Street reform as a way both to appeal to liberal values and to highlight Hillary Clinton’s ties to the financial industry. On September 17th, on the floor of the Nasdaq exchange, in New York, he declared that a “mentality has crept into certain corners of Washington and the business world that says, ‘What’s good for me is good enough.’ ” The next day, during a speech at the nonpartisan Tax Policy Center, in Washington, he said that the carried-interest loophole was contributing to economic inequality: “We’ve lost the balance between work and wealth.”

In November, the House voted to reform carried interest, but Baucus lacked the support to bring the Senate bill to a full committee vote.

After President Obama was sworn in, he was cautioned by Treasury Secretary Tim Geithner not to go after high finance too hard. Geithner worried about imperiling the fragile recovery, and he wanted to coax financiers into accepting other industry reforms. Even so, by 2010, when the recession had officially been over for several months, congressional Democrats were talking about closing the carried-interest loophole with renewed seriousness.

At that time, Carlyle and other firms were preparing public offerings, and the industry lobby seized on a little-discussed element of the reform efforts: the “enterprise-value tax,” in private-equity parlance. Raising taxes on carried interest would apply not just to a partner’s regular pay but also to the sale of a stake in a firm. Schwarzman, who still held a sizable stake in Blackstone, was particularly upset. Later, he described the period as “a war.” He said, “It’s like when Hitler invaded Poland in 1939.” (He was widely criticized for the analogy, and apologized.) KG: Unbelievable. But at the same time – beyond ego – why do you think there was such a pervasive feeling of attack amongst the private equity industry? Do you think it had to do with larger anti-Wall Street sentiment? AM: It was quite extraordinary to behold, how sensitive Wall Street was in this period to even mild comments like Obama’s reference to “fat-cat bankers.” Part of it came from feeling betrayed by Obama, who many of these guys had taken a shine to during the campaign. Part of it, perhaps, came from an overactive conscience. I wrote about this Wall Street defensiveness in a 2012 cover story for the New Republic: https://newrepublic.com/article/101726/obama-wall-street-donors-campaign-finance-tax

In May of 2010, when Rubenstein returned to Capitol Hill, he was “the perfect good guy,” a private-equity lobbyist told me. “Unlike these guys throwing themselves million-dollar birthday parties, David is donating the Magna Carta to charity.” Evan Bayh, the Democratic senator from Indiana and the son of Rubenstein’s former boss, was among those receiving visits from private-equity lobbyists, and soon Bayh was heard arguing that taxing “enterprise value” was unfair. Bayh, who left the Senate six months later, now works for Apollo, one of the largest private-equity firms. Asked to comment, he said through a spokeswoman that he “does not recall much about this given it was six years ago.”

The debate unfolded on the floor of the Senate. (Democrats had strategically attached the reforms to a larger tax package, dodging the Finance Committee.) Schumer insisted, as he had in 2007, that the legislation had to apply equally to all sectors; yet by threatening a greater variety of industries the bill was likely to become unworkable. Former Representative Barney Frank, of Massachusetts, told me, “The best way to avoid supporting what is doable is to insist on making it un-doable. Schumer wanted to broaden the bill to death.” KG: Loved this quote. Frank seems so eminently quotable. AM: That he is. I didn’t realize until relatively late in my reporting that he had been engaged on the carried-interest loophole in addition to financial reform more broadly. As usual, he did not disappoint.

Soon Democratic senators with ties to venture capital and real estate were protesting. Mark Warner, of Virginia, who, elected two years earlier, had made a fortune as the founder of the venture firm Columbia Capital, co-authored a May 11th letter to Baucus urging that the Senate retain “a capital gains incentive for those who contribute to the viability of our start-up community—venture capitalists.” The real-estate lobby, meanwhile, relied on senators like Robert Menendez, of New Jersey, for whom real-estate interests were the second-largest source of contributions; and Kay Hagan, of North Carolina, a Schumer protégée who often lined up behind him on financial issues.

At that time, Obama was shepherding the Dodd-Frank financial-reform bill through Congress, and the White House did not intervene in the carried-interest fight. Speaking about the Administration, a former senior Democratic Senate aide told me, “They’re judicious about using their lobbying—you want to use it where you’re thinking you’re going to be effective.” The White House decided that its advocacy would not “move the needle one way or another.”

Some support came from unexpected corners. On May 29th, Fred Wilson, the co-founder of Union Square Ventures and an early investor in Twitter, disputed on his blog the notion that reform would impinge on the flow of capital. “Changing the taxation of the managers will not reduce the amount of capital going to productive areas,” he wrote. “It’s time for asset managers to start paying their fair share of taxes. We are among the most highly compensated people in the world. And we’ve been getting a huge tax break for years.”

Lobbyists knew that, with the midterm election season looming, there was little time to get a controversial bill passed, and that sixty votes were required to overcome an inevitable Republican filibuster. “You’d see lobbyists raising technical issues with Democratic staffers,” Lily Batchelder, then the Democratic chief tax counsel for the Senate Finance Committee, told me. “It takes some time to educate staff members and educate their bosses that such issues are mostly smoke and mirrors”—techniques meant to stall the bill.

By June, the legislation had been weakened to the point that many ambivalent Democrats were mollified. But there were still holdouts, including Ben Nelson, a Nebraska Democrat, and the few moderate Republicans in the chamber—Olympia Snowe and Susan Collins, of Maine, and Scott Brown, who had received heavy Wall Street backing in his recent election. The former senior Senate aide told me, “Every time we’d do a whip count, we got to fifty-seven, fifty-eight. We never quite got to sixty.”

On June 8th, Rubenstein’s cell phone rang as he was speaking to supporters of the Economic Club, at the Phillips Collection. He left the stage to take the call. Among those in the audience was Gary Shapiro, the consumer-electronics lobbyist who was Rubenstein’s travel companion to Japan in the eighties. After a few minutes, Shapiro recalls, Rubenstein returned and said, “That was a senator. That one call just saved us on carried interest.” (Rubenstein denies making this comment.) KG: This is an incredible anecdote, but seems difficult to verify. What made you trust Shapiro was remembering accurately? AM: What made me trust him was that a) he had no axe to grind against Rubenstein—he admires him and b) he volunteered the anecdote without any prompting, when I asked if he’d ever heard Rubenstein discuss carried interest.

On June 30th, in the last of several votes, the package came up three votes short. In the end, Batchelder says, the private-equity lobbyists “ran out the clock.” Since 2010, when Republicans retook control of Congress, prospects for closing the loophole have not revived.

Rubenstein has maintained a good relationship with President Obama. In 2012, at the urging of the White House, Carlyle took a majority stake in a troubled Sunoco oil refinery near Philadelphia, the largest refinery on the East Coast. A few months later, Rubenstein defended Obama against charges that he is anti-business, telling Reuters, “Generally I think the Administration is quite open and accessible.” In early 2014, Carlyle hired Obama’s first chairman of the Federal Communications Commission, Julius Genachowski, as a managing director and partner in its U.S. buyout team.

Obama has continued to invoke carried-interest reform as a way to raise revenue. Rubenstein, who no longer has to contend with any real attempts to close the loophole, has little to gain by insisting that it be retained. Instead, he characterizes reform efforts as a distraction. He told Charlie Rose in 2012, “Our bigger problem isn’t carried interest. Our bigger problem is the one-trillion-dollar annual deficit and the sixteen trillion dollars of debt we have.” At the Credit Suisse forum in 2013, Rubenstein said of the potential savings from closing the loophole, “It’s a very modest amount of money.” KG: Further attempts to close the loophole seem even less likely under a Clinton presidency, no? AM: What matters most is whether the Democrats win back the House. If they do, it’s hard to see how the loophole does not finally succumb—even though Clinton has plenty of friends on Wall Street, she’ll be under great pressure to follow through on her campaign pledge to end the loophole. However, if Republicans retain the House, as seems likely, the fix will almost surely be deferred til “comprehensive tax reform,” if and when that ever happens. The other possibility is that advocates for closing the loophole success in convincing either the Obama administration or a Clinton administration to close the loophole by executive fiat, which some tax experts believe is doable. So far, the Obama White House has been very skeptical of that approach.

Victor Fleischer disagrees. He believes that the revenue gained by loophole closure would be many times as much as official projections, which have ranged from fifteen billion dollars over ten years to twenty-five billion dollars. Government models assume that private-equity firms would find ways to keep categorizing their incomes as capital gains, even once the loophole was closed. Fleischer asked me, “If the legislation would be so easy to get around, why do they spend so much time, money, and effort to defeat it?”

Writing in the Times in June of 2015, Fleischer analyzed the most recently available I.R.S. income data, which are from 2012, and described a technique of approximating the carried interest generated by financial firms. (Investment funds are not required to report that figure outright.) He estimated that, in 2012, one subset of financial firms had generated forty billion dollars in carried interest, taxable at the capital-gains rate. Had the loophole been closed, the Treasury would have taken in eight billion additional tax dollars, or eighty billion over ten years, from just this one subset. He also often argues that the government estimates could not be right, given that Schwarzman alone made around seven hundred million dollars in each of the past two years, resulting in annual tax savings of close to a hundred million dollars for a single person.

Last October, at the Carnegie ceremony, Rubenstein told me, “I don’t think anything will get done until comprehensive tax reform is discussed and everything’s looked at.” This position is both an acknowledgment that, in this election cycle, popular sentiment has shifted against the loophole, and an evasion, because of the unlikelihood of broad tax reform. Although the latest attempt to close the loophole came from Dave Camp, a Republican congressman from Michigan, as part of a 2014 plan to overhaul the tax code, the Speaker at the time, John Boehner, when asked about Camp’s plan, said, “Blah, blah, blah.” Boehner’s replacement, Paul Ryan, of Wisconsin, has said that comprehensive tax reform will not be taken up until 2017 at the earliest.

The easiest way to close the loophole would be to equalize the rates on capital gains and regular income, as was done in 1986, but this would encounter staunch Republican opposition in a legislative fight. Marco Rubio, whose chief campaign fund-raiser is Wayne Berman, now the head of Blackstone’s in-house lobbying operation, is proposing to do away with capital-gains taxes entirely.

Major philanthropists today do not quote indiscriminately from Andrew Carnegie’s “Gospel.” In one passage, Carnegie writes that making a large charitable gift is “a much more potent force for the elevation of our race’’ than dividing the money into “trifling amounts” for distribution as donations or higher wages, which would likely be “wasted in the indulgence of appetite.” He says that “even the poorest can be made to see this.” KG: Why did you decide to include this here? The implication seems to be that even if they do not quote from it, they still take it as gospel! Do you think they are aware that this is where these ideas come from? AM: The purpose in quoting Carnegie again here was to note that there is another side of the coin, as it were, when it comes to high-end philanthropy. There was in Carnegie’s time and there is now. The more positive side of it is that these very wealthy people are willing to give away much of their money to charity, and encourage others to do so as well. The other side, that gets less notice, is that many of them believe very strongly that the money is put to better purposes if they give it away themselves than if it were distributed more broadly to society in the form of higher wages for their employees or taxes paid into the public weal. It’s worth recalling that even as Carnegie was giving away so much of his fortune, he was also paying workers so little that it precipitated a bloody steel-worker strike in Homestead, Pa. that claimed a dozen lives.

David Rubenstein’s patriotic philanthropy can be seen as a way of establishing the level of control over his wealth that Carnegie enjoyed. In Carnegie’s time, there was no federal income tax; charity was the primary means the rich had of giving back to society, and they could, of course, determine the size of their contributions. The super-wealthy now view taxes more or less the way Carnegie viewed higher wages, or alms spread among the needy: as more likely to be frittered away than if they bestowed the money themselves. The tax code supports this view, making charitable giving tax-deductible. By 2013, the amount written off by all taxpayers was more than forty billion dollars annually. The wealthy benefit the most, because they are deducting income that would otherwise be taxed at the highest personal rate.

The Library of Congress dinners remain one of Rubenstein’s most useful tools for strengthening his influence. Last November, the guest was Robert Caro, speaking about Lyndon Johnson. There were ten tables, with ten settings each, and two red armchairs positioned on risers at the front of the room. Among the members of Congress who attended were several Democratic senators who had figured prominently in the carried-interest debate: Chuck Schumer, Mark Warner, and Kay Hagan, the Schumer protégée, who lost her North Carolina seat in 2014.

Representative Bill Posey, a Florida Republican, stepped outside after dinner. “I love these things—they’re out of the park,” he told me. “They’re so enlightening about history.” Posey was unaware that Rubenstein paid for the dinners. One staff member at the library, referring to earlier events, told me, “I looked around and thought, This is pretty chummy here. These members of Congress don’t even know they’re being lobbied.”

Recently I spoke with Morris Pearl, who in 2014 retired as a managing director at BlackRock, the asset-management firm, to become chairman of the Patriotic Millionaires, a group of wealthy advocates for higher taxes on the rich, which was organized in 2010. (The membership now numbers about two hundred and includes Norman Lear, the TV producer, and Leo Hindery, Jr., a private-equity executive who has for years supported closing the carried-interest loophole.) I asked Pearl whether philanthropy mitigated the need for reform. “We need to make collective decisions by our elected representatives on how to spend our money,” he said. “It’s not up to each individual person to decide how to spend the money.”

On November 18th, Pearl joined Sander Levin, now the top Democrat on the House Ways and Means Committee, at a press conference to renew the call for closing the carried-interest loophole. Levin said, “There’s more and more insistence in this country on fairness and a belief that this institution does not respond to the circumstances of the typical family and the typical worker.” He told me, “Philanthropic contributions don’t answer the need for tax fairness. Under that theory, why not just lower the tax rate still more and the rich will have more money to give away?”

Many of today’s Wall Street philanthropists win the public’s esteem by giving away money that, without the loophole they’ve fought to protect, would not all have been theirs to donate. “I don’t want to bash the philanthropy, because it does good,” Victor Fleischer told me. “But we’re creating what’s essentially a parallel system, where a small number of individuals control quasi-public spending, and that will reflect their values and not democratic values.” Of Rubenstein, he said, “It’s great that he’s helping out with the Washington Monument. But, if we had a government that was better funded, it could probably fix its own monuments.” KG: What a perfect way to come around full circle. It seems to me now that this is, in fact, the heart of the story. That you’ve not hit the reader over the head with the big idea and then tried to back into it, but led the reader along to it bit by bit. Is this the way you often develop ideas in a piece? Did you plan to do it this way from the beginning? Would you agree that this is the animating spirit of the story? That in some ways the carried interest loophole is essentially antidemocratic? AM: Thank you. Yes, another reason why I started the piece as I did, with the Monument, is that I knew that I’d be able to circle back to that opening here. It served to bring it all together. I saw the animating spirit of the story as a quest for connection: getting us to think about these two topics that are usually discussed in isolation (a tax loophole for private equity and large-scale philanthropy by Wall Street) as being very much related. To realize that the story of carried interest isn’t just about a quirk in the tax code but about how we have decided to organize our society and fund our government and the public realm.

This entry was posted on Monday, June 6th, 2016 at 4:25 pm. It is filed under Behind the Story, Featured. You can follow any responses to this entry through the RSS 2.0 feed.

Comments are closed.