By Peter Ward January 20, 2017

Swamp Monsters at Goldman Sachs

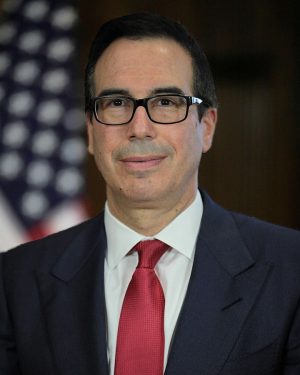

Steve Mnuchin, Goldman alumn and Donald Trump’s pick for Treasury secretary. ©By Office of the President-elect, CC BY 4.0

Goldman Sachs has been the subject of protests this week, in the build up to Donald Trump’s inauguration as President. A crowd of around 100 people has been camped outside the bank’s headquarters in New York, some wearing swamp creature masks. Protesters have focused on Goldman’s influence over government, and Trump’s promise to ‘drain the swamp’ of Washington D.C., prior to announcing several ex-Goldman Sachs employees for positions in his government.

In a story in The Guardian this week titled, “‘The swamp is Goldman Sachs’: how the bank is rewarded for putting profits over people,” Sarah Jaffe writes about the Goldman Sachs protest and takes an in-depth look at the influence Goldman has on politics and government.

“It’s about highlighting the lie that was told to millions of people in this country, the lie that Trump was draining the swamp. If we really want the swamp to be drained, we have to do it ourselves and we’re doing it by going to Goldman Sachs,” Nelini Stamp of the Working Families party tells Jaffe.

Jaffe also finds someone who voted for Trump, but has since become disillusioned by his appointments, which include Goldman alumns Steven Mnuchin, Gary Cohn, Anthony Scaramucci, Dina Powell and Steve Bannon.

Trump is certainly not the first to put Goldman Sachs bankers in high ranking government positions. If confirmed, Mnuchin would be the third of the past four treasury secretaries to have been hired for that job from Goldman’s ranks. Some wonder why the bank is being rewarded following its catastrophic economy-smashing failures of the subprime mortgage crisis. Critics say the bank is so deeply enmeshed in government that it has enormous power to influence policy to benefit itself.

Cost of a ‘Ghost’ Army

Afghan soldiers. ©By Afghanistan Matters from Brunssum, Netherlands – The Stare of an Afghan SoldierUploaded by GiW, CC BY 2.0

The U.S. army revealed this week that it was paying 30,000 Afghan soldiers who may not exist.

Major General Richard Kaiser said that as of this month the U.S. military will only pay Afghan soldiers who have identity cards and have been biometrically enrolled in the country’s army, Jessica Donati reports in The Wall Street Journal this week. Biometric enrollment involves identifying someone by a biological trait, such as an iris scan or a fingerprint.

“Step one is knowing who you have, step two is whether they show up for work or not,” Major General Kaiser said.

The move comes as the U.S. attempts to crackdown on widespread corruption in all aspects of the Afghanistan economy and military. The U.S. government watchdog, the Special Inspector General for Afghanistan Reconstruction, has warned that corruption could fatally undermine the mission in the country. The watchdog has also claimed that Afghan soldiers have sold weapons and vehicles to the enemy.

The U.S. military says the decision to stop paying the Afghan government based on the Afghan army’s own reporting of the size of the forces will save around $13 million a month. The Afghan army has until the summer to prove that the 30,000 soldiers do in fact exist, and need to be paid.

The Value of U.S. Allies

NATO Ministers of Defense and of Foreign Affairs meet at NATO headquarters in Brussels, 2010. ©By DOD photo by U.S. Air Force Master Sgt. Jerry Morrison

Donald Trump, soon to be president of the U.S., has questioned the return the country gets from defending its allies abroad. An interactive article by Max Fisher and Sergio Pecanha in The New York Times shows exactly what the U.S. puts in and gets out of its alliances.

Treaties with more than 30 countries help to bring stability to areas that are both economically and politically important for the United States. For example, America and the European Union share mutual defense treaties, and trade between the U.S. and the E.U. stood at around $699 billion for 2015.

The U.S. promises the E.U. it will defend NATO states, act as a deterrent against Russia and provides a fleet in Naples Italy and military training and exercises across the continent. In return, the United States gets a promise that NATO states will defend it, the $699 billion in trade, military bases near Russia, the Middle East and Africa, counterterrorism and intelligence sharing, and allies cover 34% of the U.S. basing costs, an agreement worth $2.5 billion to the U.S. annually.

The U.S. enjoys similar deals with other regions, and benefits from $194 billion in annual trade with Japan, $115 billion with South Korea, and $1.2 trillion of trade via the South China Sea.

JP Morgan Chase Settles Discrimination Case

Jamie Dimon, CEO of JP Morgan Chase, who recently got a $1 million raise to $28 million. © Steve Jurvetson/Flickr

JP Morgan Chase has agreed to pay $55 million to settle charges that it discriminated against minorities.

The complaint, filed by U.S. attorney Preet Bharara alleged that the biggest bank in America discriminated against 53,000 African American and Hispanic mortgage-seekers between 2006 and 2009.

Minority borrowers were owed “tens of millions of dollars in damages”, the government claimed, because JP Morgan Chase was charging them higher rates and fees than “similarly situated white borrowers.”

“Even when Chase had reason to know there were disparities, however, Chase did not act to determine the full scope of these wholesale pricing disparities, nor did it take prompt and effective action to eliminate those disparities, nor did it engage in adequate efforts to remedy the impact of those disparities upon the borrowers,” the government charged in the lawsuit.

Despite agreeing to settle, JP Morgan denied any wrongdoing, as is par for the course in these cases.

The Week’s Top Headlines

Steven Mnuchin, Treasury Nominee, Failed to Disclose $100 Million in Assets – Alan Rappeport, The New York Times

Netflix Original: New shows drive blockbuster quarter – Rishika Sadam, Reuters

Draghi Urges German Patience on Inflation as Euro Area Heals – Piotr Skolimowski, Bloomberg News

Futures regulator fines Citigroup $25 million for spoofing in U.S. Treasury market – Francine McKenna, Marketwatch

May Insists Banks of ‘Huge Value’ as They Step Up Plans to Exit – Robert Hutton, Timothy Ross, Bloomberg News

Wall St. slips as countdown to Trump’s swearing-in begins – Yashaswini Swamynathan, Reuters

Apple and Amazon end decade-long audiobook exclusivity deal – Jacob Kastrenakes, The Verge

Judge to block mega-merger of Anthem and Cigna – Josh Kosman, New York Post

Pizza Hut Is Looking to Fill 11,000 U.S. Jobs for the Super Bowl and Beyond – Phil Wahba Fortune

Toshiba shares crash as nuclear writedown crisis deepens – BBC

This entry was posted on Friday, January 20th, 2017 at 4:20 pm. It is filed under Week in Review. You can follow any responses to this entry through the RSS 2.0 feed.

Comments are closed.